Natural gas production in Alberta

In 2014, the vast majority (over 92%) of Alberta’s total natural gas production came from sources of conventional natural gas. That is, the geological formations where gas has traditionally been found in our province.

Over the past decade, Alberta’s conventional gas production has declined. In 2014, Alberta’s conventional gas production averaged 9.4 billon cubic feet (Bcf) per day. This is a noticeable decrease from 2001, when our conventional gas production peaked at 14.4 Bcf per day.

This decline has primarily been due to reduced productivity of gas wells over time, as their reserves have been produced, and as smaller and smaller gas pools have been found. (Bigger pools of natural gas or oil tend to be found first because they’re easier to find. They are also the most sought-after targets of exploration.)

There have been changes as well in where and how Alberta’s natural gas is used.

Due to the surge in U.S. shale gas production, combined with the decline in our natural gas production and a slower start on developing our unconventional gas resources, Alberta does not export as much natural gas as we did in the past. In 2007, Alberta exported 7 Bcf of natural gas each day to the U.S. In 2014, Alberta exported 4.1 Bcf per day — a reduction of over 40%.

Before the U.S. shale gas revolution, Alberta used to sell large volumes of natural gas to distant markets in the U.S. Northeast. Today, Alberta’s natural gas has been ‘backed out’ of those markets by sources of U.S. shale gas that are located much closer to those markets.

For example, the Marcellus shale gas area is in Pennsylvania. It is cheaper for customers in the U.S. Northeast to purchase U.S. shale gas from the Marcellus — right in their backyard — than it is to purchase Alberta’s gas, which needs to be transported from far away. This may even be the case for markets in eastern Canada.

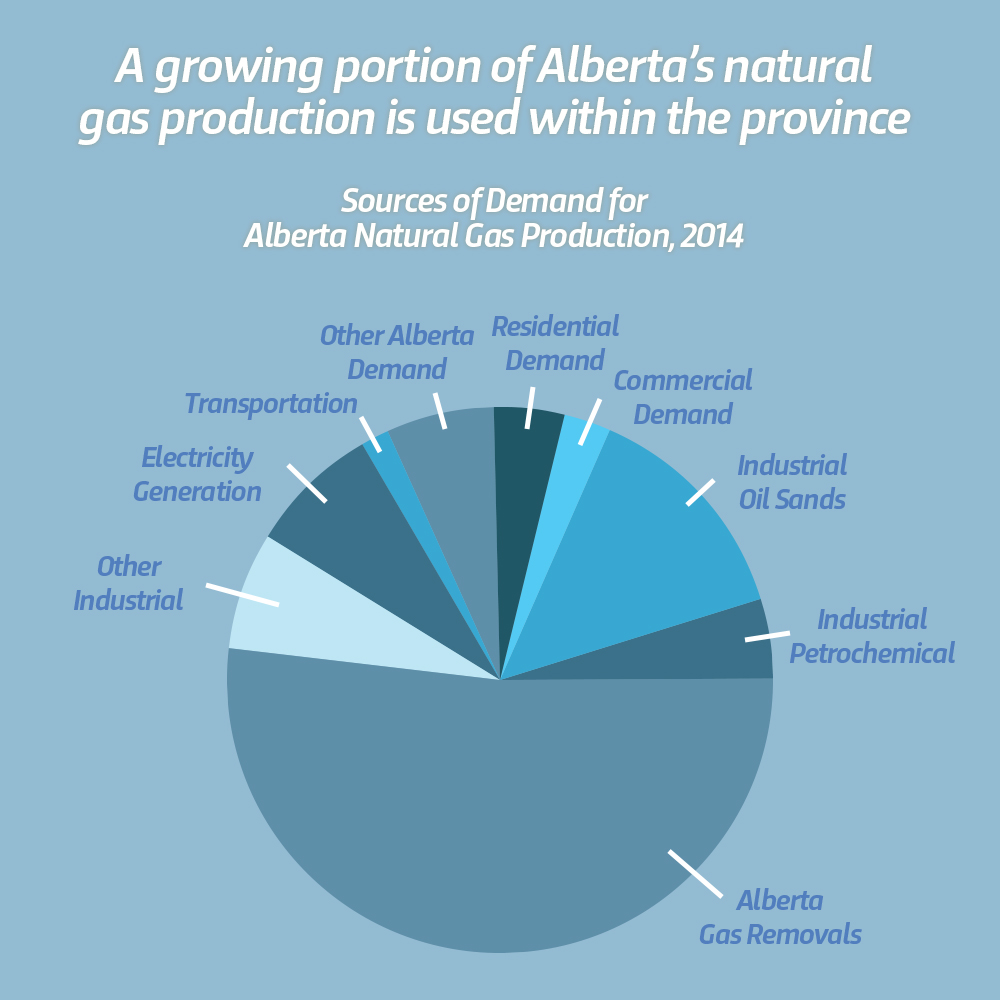

While Alberta’s natural gas exports to the U.S. have been decreasing, an increasing share of Alberta’s gas production has been used within the province.

Part of this increase can be attributed to the expansion of oil sands development. Oil sands projects commonly use steam to separate bitumen from sand, and use natural gas to generate this steam. Many projects also use natural gas for electricity cogeneration, a process where electrical power and heat are made together in an efficient way.

In the chart below, you can see that increasing amounts of natural gas have been consumed by all aspects of the oil sands industry. In particular, in situ oil sands projects have been a significant source of this growth. This reflects the fact that the vast majority of Alberta’s oil sands resources are recoverable by in situ methods, rather than mining projects.

The increased use of natural gas in oil sands project expansions has helped offset some of the reduced U.S. demand. However, demand for Alberta’s natural gas is still lower today than it has been in the past.

Some people have suggested that reduced U.S. demands could be further offset by future developments within Alberta that consume gas. (For example: fuel switching from coal to natural gas for electricity generation; further oil sands project expansions; or developments in the petrochemical sector.)

However, to serve more sources of natural gas demand, we’ll also need more natural gas supplies. That means finding natural gas that can be produced at low prices (which we have now and might see for some time).

In fact, if Alberta’s current natural gas exports to the U.S. were cut in half (which the Alberta Energy Regulator forecasts could occur by 2022), we would need to double the size of current demand in all three sectors (electricity generation, oil sands and petrochemicals) just to maintain current production levels.

Source: Alberta Energy; Alberta Energy Regulator